Here is the web site URL: https://onlinetitleloans.co/. If you are looking for quick money relief, on line title loans provide a effortless Resolution. These financial loans let you leverage your vehicle's title to safe cash quickly, usually with no stringent credit checks linked to common loans. Whether you are in Texas, Wisconsin, or Tennessee, knowledge the nuances of title loans can assist you make educated conclusions.

What Are Title Financial loans?

Title loans are secured financial loans where by borrowers use their automobile's title as collateral. The loan volume is often according to a percentage of the car's price. Unlike standard loans, title financial loans usually have fewer stringent credit history needs, creating them available to individuals with much less-than-excellent credit rating histories.

Great things about On line Title Financial loans

Rapid Approval and Funding: On the internet title financial loans often provide immediate acceptance processes, with some lenders offering same-day funding. Maintain your Motor vehicle: Borrowers can carry on to utilize their automobiles though repaying the personal loan, providing they meet up with the repayment conditions.Small Credit Checks: Several on line title mortgage suppliers emphasis extra about the automobile's benefit in comparison to the borrower's credit rating rating.Advantage: The applying method is usually uncomplicated and will be completed from your comfort and ease of your private home.

Title Loans in Texas

Texas inhabitants trying to find title loans can gain from the state's rather lenient restrictions. In line with OnlineTitleLoans.co, Texas title loans present:

- Flexible Personal loan Amounts: Mortgage amounts change based upon the automobile's price, with a few lenders providing as many as $5,000.

Rapid Processing: Several lenders deliver identical-working day funding on acceptance.Negligible Documentation: Standard necessities frequently contain a clear automobile title, proof of cash flow, and a legitimate ID.

Title Loans in Wisconsin

Wisconsin citizens may obtain on line title financial loans. Though certain terms may differ, frequent characteristics contain:

On the web Programs: All the software approach can usually be finished on the net. - Brief Selections: Lots of lenders give fast acceptance choices.

- Car or truck Inspection: Some lenders may perhaps demand a auto inspection to find out its benefit.

Title Loans in Tennessee

Tennessee features title loans with precise laws. As observed by TFC Title Loans, Tennessee title loans give:

- Swift Usage of Income: Ideal for emergencies, title loans in Tennessee present quick funding, typically in just 24 hours.

Quick Qualification: Approval relies on the worth of your car or truck, not intensely on the credit score. Retain Car or truck Use: You'll be able to keep on utilizing your auto while repaying the loan, supplied you satisfy your payment obligations.

The way to Submit an application for an on-line Title Personal loan

Implementing for a web based title personal loan typically involves the subsequent ways:

Complete an Online Software: Present particular and motor vehicle data by way of a secure on line variety. Submit Necessary Documents: Upload required documents including the motor vehicle's title, proof of money, and identification. Automobile Inspection: Some lenders may perhaps demand a photo or in-human being inspection on the motor vehicle. - Critique Mortgage Conditions: Very carefully read and fully grasp the mortgage settlement, which includes desire costs and repayment conditions.

Get Funds: On approval, money are generally disbursed by way of immediate deposit or Look at.

Factors Right before Taking Out a Title Financial loan

- Curiosity Premiums: Title loans typically have higher curiosity costs in comparison to classic loans.

Repayment Phrases: Make sure you can fulfill the repayment routine to prevent likely car or truck repossession. Loan Quantity: Borrow only what you may need and might find the money for to repay. Lender Standing: Research and choose trustworthy lenders with clear conditions.

Possibilities to Title Financial loans

For anyone who is hesitant about getting out a title bank loan, take into account these alternate options:

Personalized Loans: Unsecured financial loans that don't need collateral.- Bank cards: Should you have offered credit score, This may be a short-term Option.

Payday Option Loans (PALs): Supplied by some credit unions with lessen costs and prices. Borrowing from Loved ones or Friends: Whilst likely unpleasant, This may be a no-interest solution.

Conclusion

On the web title financial loans is usually a practical choice for people in Texas, Wisconsin, and Tennessee seeking swift usage of income. On the other hand, It is crucial to grasp the terms, curiosity costs, and opportunity hazards included. Normally tennessee title loans ensure you can meet the repayment terms in order to avoid getting rid of your vehicle. To find out more or to apply, check out OnlineTitleLoans.co.

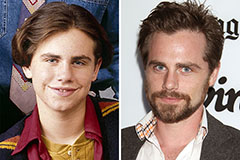

Rider Strong Then & Now!

Rider Strong Then & Now! Amanda Bynes Then & Now!

Amanda Bynes Then & Now! Bug Hall Then & Now!

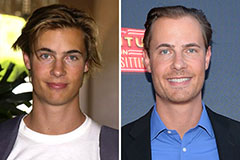

Bug Hall Then & Now! Erik von Detten Then & Now!

Erik von Detten Then & Now! Atticus Shaffer Then & Now!

Atticus Shaffer Then & Now!