Here is the web site URL: OnlineTitleLoans.co. This platform provides a streamlined process for getting

Knowledge Title Loans

Swift Use of Resources: Title financial loans frequently supply quick acceptance and funding, from time to time throughout the exact working day. Minimal Credit Specifications: Because the mortgage is secured by your automobile, credit score checks could be considerably less stringent. Continued Car Use: Borrowers can carry on driving their car during the loan time period.

How On the net Title Loans Function

Implementing for just a

Application Submission: Give particulars about you along with your vehicle by an internet sort.Documentation Evaluate: Post necessary paperwork, which include your automobile's title, evidence of earnings, and identification. Acceptance Procedure: Lenders evaluate your application and decide the personal loan quantity determined by your vehicle's value. Obtaining Resources: Upon approval, money are disbursed, generally by using direct deposit or Verify. Repayment Phrases: Repay the personal loan as agreed, maintaining in mind the interest charges and charges linked.

Title Financial loans in Texas

Texas inhabitants trying to find

Title Financial loans in Wisconsin

In Wisconsin, acquiring a title personal loan Wisconsin is straightforward, with lots of lenders giving on-line purposes. The bank loan amount is usually determined by the car or truck's value, and borrowers can generally proceed using their motor vehicle throughout the financial loan period. It truly is advisable to check distinctive lenders to discover the finest prices and phrases that accommodate your economic condition.

Title Loans in Tennessee

Tennessee citizens keen on tennessee title loans can take a look at numerous possibilities that cater for their unique requirements. Lenders in Tennessee may possibly give financial loans based on the value in the borrower's motor vehicle, with conditions that allow for ongoing usage of the vehicle. Just like other states, It is really crucial to evaluation the bank loan phrases meticulously and guarantee you can fulfill the repayment obligations.

Great things about On the net Title Financial loans

Deciding on a web based title bank loan delivers many rewards:

Ease: Apply from anywhere with no will need to visit a physical locale. Pace: Quick acceptance and funding processes. - Accessibility: Accessible to folks with various credit history histories, presented they personal a qualifying vehicle.

Criteria Ahead of Applying

Right before continuing by using a title loan, consider the next:

Interest Premiums: Title financial loans can have higher fascination prices compared to regular loans. Repayment Conditions: Make sure you can satisfy the repayment program to stop possible repossession of your respective automobile.Loan Total: Borrow only what you require and can manage to repay.

Conclusion

Title loans might be a practical solution for all those needing swift funds, especially when classic credit rating avenues are unavailable. By understanding the process and carefully thinking about the phrases, you title loans online may make an knowledgeable determination that aligns with all your economical needs. For more information and to use, visit OnlineTitleLoans.co.

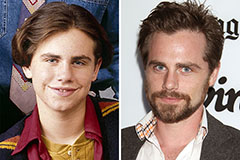

Rider Strong Then & Now!

Rider Strong Then & Now! Danielle Fishel Then & Now!

Danielle Fishel Then & Now! Macaulay Culkin Then & Now!

Macaulay Culkin Then & Now! Samantha Fox Then & Now!

Samantha Fox Then & Now! Meadow Walker Then & Now!

Meadow Walker Then & Now!